You know you should have a budget. Everyone says so. But every time you try, you end up with a complicated spreadsheet that you abandon after a week. Or you download an app, stare at it for five minutes, and never open it again.

Here’s the thing: most budgets fail because they’re too complicated. They try to track every penny across 47 categories with color-coded charts and weekly review sessions. No wonder people give up.

A budget doesn’t have to be complicated. In fact, the simpler it is, the more likely you’ll actually use it. This guide will get you from zero to a working budget in 15 minutes—no spreadsheet skills required.

Why Most Budgets Fail

Before we build your budget, let’s understand why so many fail:

-

Too many categories — Nobody needs 30 expense categories. You’ll spend more time categorizing than actually managing money.

-

Unrealistic expectations — If you’ve never budgeted, you can’t predict exactly what you’ll spend. Your first budget will be wrong. That’s okay.

-

All restriction, no fun — Budgets that cut out all enjoyment don’t last. You need a “fun money” category or you’ll rebel against your own rules.

-

No flexibility — Life is unpredictable. A budget that breaks the first time something unexpected happens isn’t useful.

-

Too much work — If maintaining your budget takes an hour a week, you won’t do it. Simple systems win.

The budget we’re about to create avoids all of these traps.

The Mindset Shift You Need

Most people think of budgets as restrictions. “I can only spend $200 on food.” “I’m not allowed to buy coffee.”

Flip that thinking. A budget isn’t a restriction—it’s a permission slip.

When you have a budget, you know exactly how much you can spend guilt-free. $200 for entertainment this month? Great—spend it however you want without worrying. That’s freedom, not restriction.

A budget removes the constant background anxiety of “can I afford this?” You’ve already done the math. The answer is yes or no, and either way, you know.

Step 1: Know Your Actual Income (2 Minutes)

Grab your phone or a piece of paper. Write down your monthly take-home pay.

Take-home pay = what actually hits your bank account after taxes, health insurance, and retirement contributions are deducted.

If you’re salaried, this is easy—check your last pay stub and multiply by how often you’re paid:

- Paid monthly: Use that number

- Paid twice a month: Multiply by 2

- Paid every two weeks: Multiply by 2.17 (there are 26 pay periods per year)

If your income varies (freelance, tips, commission):

- Look at your last 3-6 months

- Use the lowest month as your baseline

- Treat anything above that as bonus money

Don’t include:

- Money you might get (bonuses, tax refunds)

- Side income that isn’t consistent

- Money earmarked for specific debts

Write down your number: $_______/month

Step 2: List Your Fixed Expenses (3 Minutes)

Fixed expenses are the bills that stay roughly the same every month. You can’t easily change these in the short term.

Go through this list and write down what applies to you:

| Category | Your Amount |

|---|---|

| Rent/Mortgage | $_______ |

| Utilities (electric, gas, water) | $_______ |

| Internet | $_______ |

| Phone | $_______ |

| Insurance (car, health, renter’s) | $_______ |

| Car payment | $_______ |

| Minimum debt payments | $_______ |

| Subscriptions (Netflix, Spotify, gym) | $_______ |

| Transportation (bus pass, parking) | $_______ |

| Childcare | $_______ |

| TOTAL FIXED | $_______ |

These are your non-negotiables. They get paid first, every month, no exceptions.

Pro tip: If you’re not sure about utility averages, check your last 3 months of statements. Use the highest month as your budget number.

Step 3: Estimate Your Variable Expenses (5 Minutes)

Variable expenses change month to month. This is where most people underestimate. If you’re not sure where your money goes, start with our quick guide on finding out where your money goes.

Don’t guess—look at actual data. Open your bank app and check the last 2-3 months. What did you actually spend on:

| Category | Month 1 | Month 2 | Month 3 | Average |

|---|---|---|---|---|

| Groceries | $_______ | $_______ | $_______ | $_______ |

| Gas/Transportation | $_______ | $_______ | $_______ | $_______ |

| Dining out | $_______ | $_______ | $_______ | $_______ |

| Entertainment | $_______ | $_______ | $_______ | $_______ |

| Shopping (clothes, household) | $_______ | $_______ | $_______ | $_______ |

| Personal care | $_______ | $_______ | $_______ | $_______ |

| TOTAL VARIABLE | $_______ |

Be honest. If you spent $400 on dining out last month, write $400. The point isn’t to judge yourself—it’s to see reality.

Keep it simple: Don’t create 20 categories. 5-7 is plenty. Combine similar things (all food can be one category if you want).

Step 4: Do the Math (2 Minutes)

Now for the moment of truth:

Monthly Income: $_______

- Fixed Expenses: $_______

- Variable Expenses: $_______

= What's Left: $_______Three possible outcomes:

Outcome A: Positive Number

You have money left over. Great! This is your savings and buffer. Skip to Step 5.

Outcome B: Zero or Close to It

You’re breaking even. Not bad, but no room for savings or emergencies. You’ll need to either increase income or decrease spending somewhere. Start by looking at variable expenses for cuts.

Outcome C: Negative Number

You’re spending more than you earn. This is unsustainable. Don’t panic—now you know. Look at both fixed expenses (can you reduce rent, cancel subscriptions?) and variable expenses (where can you cut back?).

Step 5: Assign Every Dollar a Job (3 Minutes)

If you have money left over after expenses, decide where it goes before the month starts. Unassigned money tends to disappear.

Priority order:

- Emergency fund — Until you have $1,000 saved, put extra money here first

- Debt payoff — Extra payments beyond minimums

- Savings goals — Vacation, new car, house down payment

- Fun money — Yes, include this. Budgets without fun don’t last

Example:

Money left over: $600

- Emergency fund: $200

- Extra debt payment: $200

- Vacation savings: $100

- Fun money: $100

= Unassigned: $0The goal is $0 unassigned—not $0 in the bank, but $0 without a purpose. Every dollar should have a job before you spend it.

The Three Beginner-Friendly Budget Methods

Not sure which approach to use? Here are three proven methods, from simplest to most detailed.

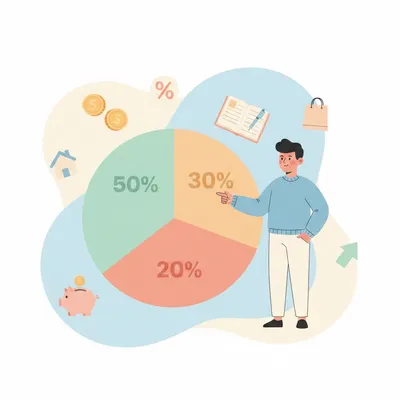

Method 1: The 50/30/20 Rule

The simplest approach. Split your after-tax income into three buckets:

- 50% Needs — Rent, utilities, groceries, transportation, insurance, minimum debt payments

- 30% Wants — Dining out, entertainment, shopping, hobbies, subscriptions

- 20% Savings — Emergency fund, retirement, extra debt payments, future goals

Example with $4,000 income:

- Needs: $2,000

- Wants: $1,200

- Savings: $800

That’s it. As long as you stay within those percentages, you’re fine.

Best for: People who hate tracking details and want a simple framework.

Limitation: Doesn’t work if your needs exceed 50% (common in high-cost cities).

Method 2: Pay Yourself First

Instead of budgeting every category, focus only on savings.

- Decide how much to save (start with 10-20% of income)

- Set up automatic transfer on payday—money moves to savings before you see it

- Whatever’s left is yours to spend however you want

Example:

- Income: $4,000

- Auto-transfer to savings: $600 (15%)

- Spending money: $3,400

Best for: People who are good at not overspending but bad at active budgeting.

Limitation: Doesn’t help if you’re already overspending—you need to know where money is going first.

Method 3: Zero-Based Budget

Every dollar gets assigned to a specific category before the month starts. At the end of your budget, income minus expenses equals zero.

Example:

Income: $4,000

Rent: $1,200

Utilities: $150

Groceries: $400

Transportation: $300

Insurance: $200

Dining out: $200

Entertainment: $150

Shopping: $100

Savings: $500

Emergency fund: $200

Debt payoff: $200

Fun money: $200

Buffer: $200

TOTAL: $4,000Best for: People who want maximum control and visibility over their money.

Limitation: Requires more active management and adjustment.

Your First Month: What to Expect

Let’s be real: your first budget will be wrong. That’s not failure—that’s data.

Week 1-2: Tracking Phase

Just track what you spend. Don’t try to restrict yourself yet. The goal is to see where your money actually goes versus where you think it goes.

Most people are surprised. Common discoveries:

- “I spend HOW much on food delivery?”

- “Wait, I have 7 subscriptions?”

- “The ‘small’ purchases add up way more than I thought”

Week 3-4: Adjustment Phase

Now that you have real data, adjust your budget categories to be realistic. If you budgeted $200 for groceries but spent $350, either:

- Increase the grocery budget and decrease something else

- Find ways to actually spend $200 on groceries

Month 2 and Beyond

Each month gets easier. You’ll learn your patterns. You’ll get faster at tracking. Your estimates will become more accurate.

The goal isn’t perfection—it’s progress. A budget that’s 80% accurate is infinitely better than no budget at all.

5 Beginner Mistakes to Avoid

Mistake 1: Making It Too Complicated

You don’t need 25 categories, a color-coded spreadsheet, and daily reconciliation. Start simple. You can add complexity later if you want it.

Mistake 2: Forgetting Fun Money

A budget with zero entertainment budget is a budget you’ll abandon. Include money for things you enjoy—guilt-free.

Mistake 3: Ignoring Irregular Expenses

Car registration. Holiday gifts. Annual subscriptions. Insurance premiums. These aren’t surprises—they happen every year. Add a “sinking fund” category: divide the annual total by 12 and save that amount monthly.

Example irregular expenses:

- Car registration: $200/year = $17/month

- Holiday gifts: $500/year = $42/month

- Amazon Prime: $140/year = $12/month

Mistake 4: Being Too Restrictive

If your first budget cuts dining out from $400 to $50, you’ll fail. Make gradual changes. Cut to $300 first. Then $250 next month. Small sustainable changes beat dramatic unsustainable ones.

Mistake 5: Giving Up After One Bad Month

You’ll overspend sometimes. Life happens. One bad month doesn’t mean budgeting doesn’t work—it means you’re human. Reset and try again next month.

Tools That Make Budgeting Easier

You can budget with pen and paper. You can use a spreadsheet. But apps make it significantly easier to stick with it.

What to Look for in a Budgeting Tool

- Easy expense entry — If it takes more than 10 seconds to log something, you won’t do it

- Visual summaries — See where you stand at a glance

- Budget vs. actual — Compare what you planned to spend versus what you actually spent

- Alerts — Get notified before you overspend, not after

- Low friction — The easier it is to use, the more likely you’ll use it

Paper and Envelope System

Old school but effective. Label envelopes for each spending category. Put cash in each at the start of the month. When an envelope is empty, that category is done for the month.

Pros: Very tangible, impossible to overspend Cons: Inconvenient, doesn’t work for online purchases

Spreadsheets

Google Sheets or Excel can work if you’re disciplined.

Pros: Free, fully customizable Cons: Manual entry, easy to forget, no mobile alerts

Budgeting Apps

The modern solution. Track expenses on your phone, see visual summaries, get alerts.

Pros: Convenient, automatic calculations, reminders Cons: Small learning curve initially

How ExpenseManager Helps You

Budgeting doesn’t have to mean wrestling with spreadsheets. ExpenseManager makes it simple:

- Set category budgets in seconds — Create spending limits for each area of your life

- Track expenses instantly — Snap a photo of a receipt; AI extracts the amount and categorizes it

- Visual progress bars — See at a glance how much budget remains in each category

- Smart alerts — Get notified when you’re approaching your limit, not after you’ve exceeded it

- No manual math — The app calculates everything automatically

- Monthly summaries — See exactly where your money went with clear charts

And when you’re ready for the next level—splitting expenses with a partner or roommates—you can do that in the same app.

Conclusion

Budgeting isn’t about restriction. It’s about knowing where your money goes and making intentional choices about where you want it to go.

You don’t need a finance degree. You don’t need a complicated spreadsheet. You just need 15 minutes to set up a simple system and the commitment to check in regularly.

Start today:

- Calculate your income

- List your fixed expenses

- Estimate your variable expenses

- Assign every extra dollar a job

- Track what you spend this month

Your first budget won’t be perfect. That’s okay. The goal is to start. Adjust as you learn. Get a little better each month.

A year from now, you’ll wonder how you ever lived without knowing where your money went.

Ready to start your budgeting journey? Create your free ExpenseManager account and take control of your finances today.